Learn more about Nevada Income Taxes. Either 75 or 10000 of your retirement pay is.

Nevada Retirement Tax Friendliness Smartasset

Withdrawals from retirement accounts and public and private pension income are also not taxed whatsoever.

. By comparison Nevada does not tax any retirement income. California will tax you at 8 as of 2021 on income over 46394. The exemption can be applied to a Veteran.

Which states do not tax pensions. Up to 2000 of retirement income is exempt for taxpayers under age. Does Nevada Tax Your Retirement.

This is the list of the 37 states that will not impose a tax on your social security retirement income. Up to 3500 is exempt. State Income Tax Range.

Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire Alabama Illinois Hawaii Mississippi and Pennsylvania. Minnesota 33 of Benefits Missouri Based on Annual Income Amount Montana. 800-352-3671 or 850-488-6800 or.

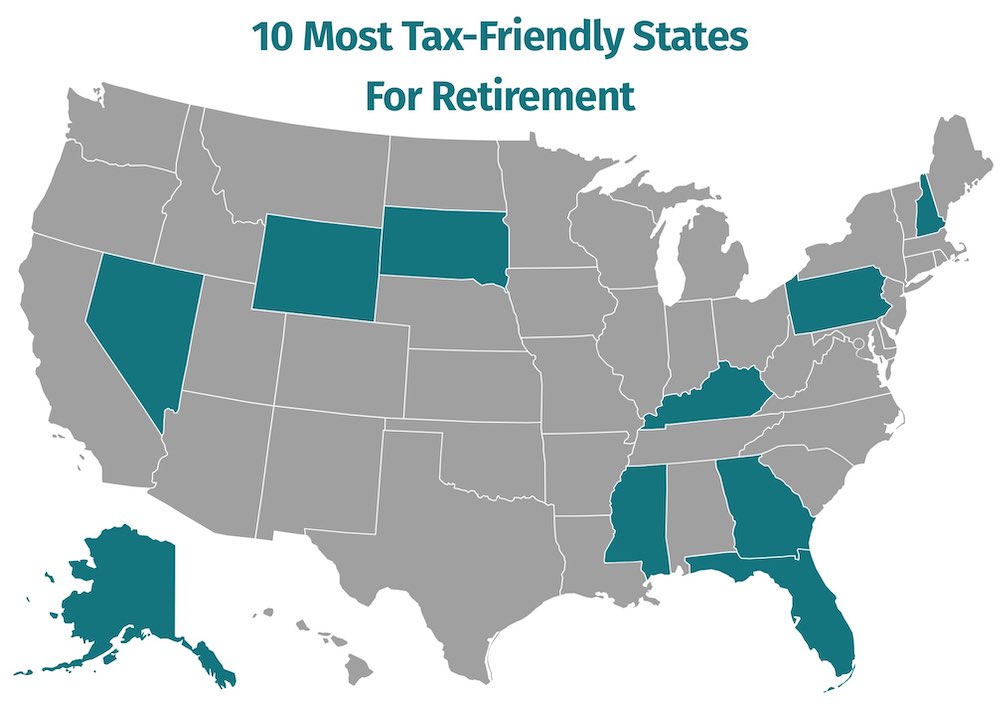

404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. If youre looking for a tax-friendly retirement Nevada is one of the places to be. Beginning in 2022 the highest rate will be 1075 on taxable income over 1 million.

Connecticut 50 of Benefits Florida no state taxes Kansas. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State and specifically moving to Las Vegas. Up to 24000 of military retirement pay is exempt for retirees age 65 and older.

Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. 20000 for those ages 55 to 64. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax.

An annual tax exemption is available to any Veteran with wartime service. 4 on taxable income up to 10000 895 on taxable income over 1 million. Local sales taxes increase this total.

323 on all income but Social Security benefits arent taxed. It is based on retirement law effective from the 75th session of the nevada legislature 2009. The following states are exempt from income taxes on Social Security Benefits.

Retirement income exclusion from 35000 to 65000. 29 on income over 440600 for single filers and married filers of joint returns 4 5. But again there are many states 14 to be exact that do not tax pension income at all.

Sales Tax California vs Nevada. There are no individual income taxes in Nevada. New Hampshire doesnt tax wages but does tax dividends and interest.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Nevada Wartime Veterans Property Tax Exemption. The city does host a return to a tax burden below 16 though at 156 just.

Is Arkansas a good state for retirement. Distributions received from the Thrift Savings Plan TSP are not taxed. Consumers in California are hit with a sales tax of 725.

In fact the state has no taxes on income or Social Security benefits. The Nevada state income tax brackets are fixed at 0 across the board but you are still responsible for paying Social Security 62 and Medicare 145 totaling 765. If youre receiving your pension from an.

State By State Guide To Taxes On Retirees Retirement Tax Retirement Income

7 States That Do Not Tax Retirement Income

A Guide To The Best And Worst States To Retire In

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Nevada Retirement Tax Friendliness Smartasset

10 States That Attract The Most Retirees Voting With Their Feet Best Places To Move Best Places To Retire Retirement

13 Places Everyone Will Be Flocking To For Retirement In The 2020s Washington Hikes Low Taxes Living In Colorado

States Without Income Tax Income Tax Inheritance Tax Income Tax Brackets

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

States That Don T Tax Retirement Income Personal Capital

Kiplinger Tax Map Retirement Tax Income Tax

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Tax Friendly States For Retirees Best Places To Pay The Least

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

37 States That Don T Tax Social Security Benefits The Motley Fool